Grundlæggende statistik

| Institutionelle aktier (lange) | 18.260.377 - 12,28% (ex 13D/G) - change of 0,07MM shares 147,36% MRQ |

| Institutionel værdi (lang) | $ 7.743 USD ($1000) |

Institutionelt ejerskab og aktionærer

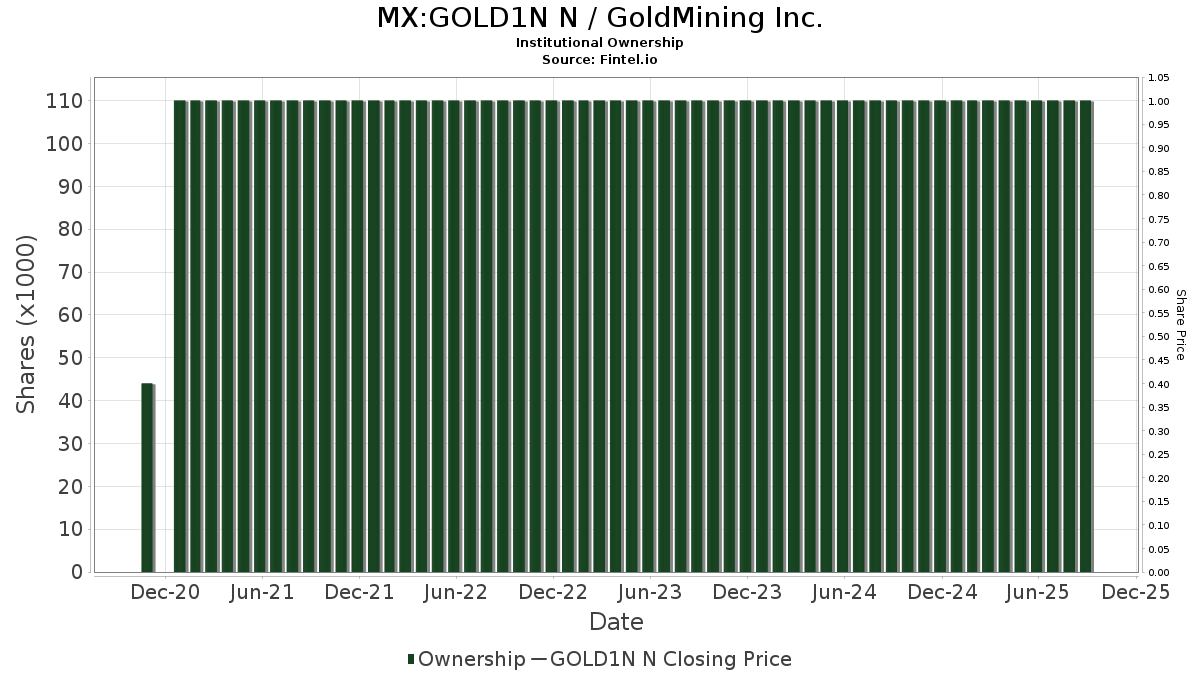

GoldMining Inc. (MX:GOLD1N N) har 62 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 18,260,377 aktier. Største aktionærer omfatter Van Eck Associates Corp, GDXJ - VanEck Vectors Junior Gold Miners ETF, Ruffer LLP, Goldman Sachs Group Inc, Marshall Wace, Llp, Renaissance Technologies Llc, Sprott Inc., Rathbone Brothers plc, Bank Of America Corp /de/, and Acadian Asset Management Llc .

GoldMining Inc. (BMV:GOLD1N N) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 5.898 | -45,88 | 4 | -55,56 | ||||

| 2025-08-07 | 13F | Prospect Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Nicholas Hoffman & Company, LLC. | 10.000 | 0,00 | 7 | -12,50 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 4.702 | -61,20 | 3 | -66,67 | ||||

| 2025-07-22 | 13F | Foguth Wealth Management, LLC. | 26.666 | 19 | ||||||

| 2025-07-24 | 13F | Financial Security Advisor, Inc. | 16.835 | 0,00 | 12 | -14,29 | ||||

| 2025-08-05 | 13F | Seelaus Asset Management LLC | 10.000 | 0,00 | 7 | -12,50 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 18.649 | 0 | ||||||

| 2025-07-28 | NP | AVDS - Avantis International Small Cap Equity ETF | 2.564 | 79,93 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 580 | 0,87 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 20.000 | 0,00 | 14 | -17,65 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 18.780 | 43,36 | 14 | 18,18 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 420.930 | 52,09 | 303 | 28,94 | ||||

| 2025-08-21 | NP | GDXJ - VanEck Vectors Junior Gold Miners ETF | 6.465.498 | -14,57 | 4.655 | -27,64 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 15.000 | 0,00 | 11 | -16,67 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 4.200 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 1.000 | 0,00 | 1 | -100,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 100.673 | 131,41 | 72 | 100,00 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 464.140 | 395,96 | 334 | 322,78 | ||||

| 2025-05-15 | 13F | Cullen Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 50 | 0,00 | 0 | |||||

| 2025-07-22 | 13F | Simplicity Wealth,LLC | 40.000 | 100,00 | 29 | 64,71 | ||||

| 2025-08-11 | 13F | One Capital Management, LLC | 109.000 | 0,00 | 78 | -15,22 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 13.100 | 5,65 | 9 | -10,00 | ||||

| 2025-05-02 | 13F | Larson Financial Group LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F/A | Mraz, Amerine & Associates, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Jeppson Wealth Management, Llc | 12.000 | 9 | ||||||

| 2025-07-31 | 13F | Northstar Asset Management Llc | 15.000 | 0,00 | 11 | -16,67 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 3.000 | 0,00 | 2 | -50,00 | ||||

| 2025-08-11 | 13F | Sprott Inc. | 322.778 | -3,30 | 232 | -18,02 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 3.485 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 27.027 | 19 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1.642 | 1 | ||||||

| 2025-05-14 | 13F | D L Carlson Investment Group Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 15.500 | 0,00 | 11 | -15,38 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 35.854 | -60,51 | 26 | -67,53 | ||||

| 2025-05-06 | 13F | Financial Sense Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 32.718 | -11,05 | 24 | -23,33 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 26.666 | 19 | ||||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 130.500 | 0,00 | 94 | -13,89 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 72.884 | 3,63 | 52 | -13,33 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 70.000 | 0,00 | 50 | -15,25 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 55.000 | 0,00 | 40 | -15,22 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 7.345.751 | -12,78 | 5 | -28,57 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 70.980 | 39,23 | 51 | 21,43 | ||||

| 2025-04-10 | 13F | Diligent Investors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Baader Bank INC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 129.204 | 58,32 | 93 | 34,78 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 125 | 0,00 | 0 | |||||

| 2025-07-11 | 13F | Lincoln Capital LLC | 10.752 | 0,00 | 8 | -12,50 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 81.000 | 0,00 | 66 | -2,94 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 54.900 | -15,93 | 40 | -29,09 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 12.342 | 9 | ||||||

| 2025-08-04 | 13F | Saxony Capital Management, LLC | 10.000 | 0,00 | 7 | -12,50 | ||||

| 2025-08-07 | 13F | Traynor Capital Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 50.421 | 12,75 | 36 | -5,26 | ||||

| 2025-05-27 | 13F | Jacobi Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 25.000 | -7,41 | 18 | -14,29 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Total Wealth Planning & Management, Inc. | 43.600 | 0,00 | 31 | -16,22 | ||||

| 2025-07-16 | 13F | Ruffer LLP | 901.996 | 0,00 | 650 | -13,70 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 6.550 | 314,56 | 5 | 300,00 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 200 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 79.134 | 365,52 | 57 | 300,00 | ||||

| 2025-05-13 | 13F | Thrivent Financial For Lutherans | 0 | -100,00 | 0 | |||||

| 2025-08-27 | NP | COPA - Themes Copper Miners ETF | 1.421 | 1 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 26.502 | 19 | ||||||

| 2025-04-17 | 13F | Grimes & Company, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Bright Financial Advisors, Inc. | 12.961 | 0,00 | 9 | -18,18 | ||||

| 2025-08-13 | 13F | Advisor Group Holdings, Inc. | 10.000 | 0,00 | 8 | 0,00 | ||||

| 2025-07-09 | 13F | Northwest & Ethical Investments L.P. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 640.594 | 102,08 | 461 | 71,38 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 9.993 | 7 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 127.458 | 0 | ||||||

| 2025-04-24 | 13F | Quilter Plc | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 8.200 | 6 | ||||||

| 2025-08-14 | 13F | Helium Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 8.974 | 7,85 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 0 | -100,00 | 0 |